We have made history together – thank you!

In this final blog as IIRC Chief Executive, Paul Druckman reflects on the scale and pace of change that the <IR> movement has been instrumental in bringing about.

When Harvard Business Review published its annual ranking of the world’s best performing CEOs in November 2015, for the first time incorporating broader issues such as governance (20%) alongside financial performance (80%), the results were astonishing. Jeff Bezos of Amazon scored highest on a purely financial analysis, but once you “account” for a broader perspective of value creation Lars Sorensen, CEO of Novo Nordisk, rose to the top of the league table and then again in 2016. Bezos’ new score was 87th!

An increasing number of businesses in the world are explaining their purpose and providing information in context, a key way of securing the trust and confidence of dedicated stakeholders and demonstrating the impact of businesses in creating the conditions for broad-based prosperity. Inclusive and integrated governance, where silos are diminished and management prioritises communication with stakeholders, attracts long-term investors, improves risk management and cuts the cost of capital.

From an <IR> perspective, the change in thinking and behaviour away from an unrelenting focus on short-term factors towards the longer term horizon has been a key development over the last five years and is one of the three economic shifts that have been at the core of our thinking. As Lars Sorensen himself says, “The business of business is business – but with a long-term perspective”. How our capital markets system creates and distributes wealth and resources is a critical question that must be addressed with urgency. Our contribution to this debate has been the International <IR> Framework and the philosophical underpinning encapsulated by the six capitals. If economies, businesses and investors broaden their capital base, investment in their people, ideas and the protection of society and the environment will be prioritised alongside, and be consistent with, sustained financial performance. That is why <IR> is fundamental to the governance of institutions and economies in the 21st century.

How markets create value and distribute resources to maximise equity has led to calls for a fundamental reform of our capitalist system. I believe that our multi-capitals approach steers a course between a respect for the full range of finite resources that sustain our planet and society, while enhancing the quality of investment that will secure our economic future. In short, it contributes towards financial stability and sustainable development. This agenda is encapsulated by the work of global organisations such as the Coalition for Inclusive Capitalism and Focusing Capital on the Long Term, as well as national regulators such as the UK’s Financial Reporting Council, which has done so much to bring attention to the importance of board culture in embedding long-term business success. While these movements, and many more, are flourishing, they are not yet embedded and that is the challenge for the next five years.

The IIRC has been more than a witness to these changes: we have actively campaigned and agitated for change in policy, regulatory approach, investment mandates and business behaviour. While the Framework provides much needed credibility, we have participated in broader movements to ensure that what is innovation today becomes the norm tomorrow. That is the legacy of the IIRC’s first five years of existence.

A number of global events have influenced our work and thinking, often strengthening the case for <IR>. When we were formed the Deepwater Horizon tragedy in the Gulf of Mexico was very fresh. The human and ecological tragedy created was underpinned in large part by failures of corporate governance. A lack of systems and of engagement; and a failure to value that which was most valuable: the social bond within BP of its connection to the environment and community. Today, as I write, ‘Deepwater Horizon’ is a box office hit, lending immortality to a shocking series of failures that integrated thinking, effective corporate governance and strong investors exercising their stewardship responsibilities can help to address. We must never forget the real world impact of governance and reporting. The IIRC is strengthened immeasurably by our close connection to market participants who inform our work.

I began this article by talking about Novo Nordisk, one of the earliest pioneers of integrated thinking and reporting. Today, <IR> is becoming the information architecture in many capital markets around the world. Because what <IR> is disrupting is the corporate reporting system, remodelling information so that it fits with corporate governance and stewardship responsibilities and practice. Nowhere has this been more effective than in Japan, where just this week the Nikkei newspaper reporting that over 300 companies will produce integrated reports next year. The new stewardship and corporate governance codes have been a major driver, along with the report by Professor Ito which proposed a number of reforms to improve the effectiveness of the capital market, the adoption of <IR> being one such recommendation.

This focus on corporate reporting as an ally of effective corporate governance and investor stewardship has also led to widespread adoption of <IR> in South Africa, and the UK, and an increasing number of companies in Singapore, Malaysia, Brazil, France, Germany, The Netherlands and very recently the exemplar of reporting in the USA, GE. Indeed, <IR> is today practiced by businesses in over 30 economies globally, a testament to the universal applicability of the concepts and its usefulness as a frame for embedding an integrated approach. What such economies are recognising is that it is impossible to have a modern, dynamic capital market without a strong and effective information architecture.

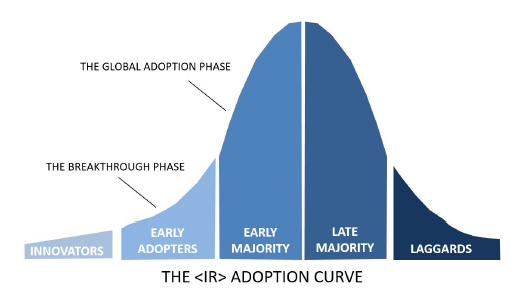

We have witnessed a noticeable shift in the interest and support of governments and regulators, particularly over the last two years. It has been a privilege to represent the IIRC as part of the B20 (the business wing of the G20) over the last three years during the Australian, Turkish and Chinese Presidencies. I am particularly encouraged by the decision of China’s Ministry of Finance to join our global Council and contribute to encouraging the adoption of <IR> in the world’s second largest economy. We have also made a submission to the Financial Stability Board taskforce on climate-related financial disclosures which will do so much to address the concerns of Mark Carney and other senior policymakers that long-term risks such as climate change are not properly factored in to today’s economic and business decision-making. So what we have created – together – is the momentum for change. When we created the IIRC five years ago, we had an idea and the  dedication of a committed family of supporters, advocates and innovators. I am pleased that our family has grown into an army of champions and early adopters – an army that is on course to transform the corporate reporting landscape as we move to early majority adoption in the coming years.

dedication of a committed family of supporters, advocates and innovators. I am pleased that our family has grown into an army of champions and early adopters – an army that is on course to transform the corporate reporting landscape as we move to early majority adoption in the coming years.

I also want to record my ongoing passion for the accountancy profession and its vital role in bringing about this transformed capital markets system. It is more often than not the CFO in organisations who drives the adoption of <IR>, valuing the strategic benefits of a more interconnected business where risks and opportunities are spotted earlier. In professional practice, accounting firms provide trusted advice and assurance that increases confidence in the governance and reporting process. And accounting bodies create the thought leadership and advocacy as part of local networks, encouraging market adoption. I do believe that <IR> offers the profession with a path to the future, enhancing its relevance. My vision is for profession that understands and accounts for value in its multiple dimensions. It is an agenda that is there for the taking and the qualities, training, expertise and insights that accountants possess means they are ideally placed to take on this strategic and historic role. I encourage the profession to further step up its commitment to <IR> as we move towards a breakthrough in many markets.

It has been my immense privilege to serve as the IIRC’s CEO during these formative years. As I depart as Chief Executive, an exciting new chapter will open and I cannot think of anyone better qualified or prepared to take on this role than my successor, Richard Howitt. A leader and a friend, he will make a thoughtful and energetic CEO and he will be brilliantly served by the talented IIRC team. I must also acknowledge the truly remarkable leadership of Mervyn King, who persuaded me to accept this role five years ago. It is fitting that on 1 November the King IV corporate governance code will be launched in South Africa, the first outcomes-based governance code in the world, and completely aligned to the International <IR> Framework.

I could not write this final article without reflecting personally on the truly amazing journey – literally – around the world in the last five years. Indeed, I took 51 flights in 2015, which is enough flying for anyone! It has been the best job I have ever had. To all of those people I have met I say ‘thank you’. I have learnt so much from you and have been inspired by your leadership and valued your friendship. I genuinely believe we have changed the course of corporate reporting, contributing towards a more resilient economy and, yes, to saving the world! We have altered the terms of the debate in capital markets which will benefit our economy, our society and our precious, albeit precarious, planet.