Get to grips with the six capitals

The primary purpose of an integrated report is to explain to financial capital providers how an organisation creates value over time. The best way to do so is through a combination of quantitative and qualitative information, which is where the six capitals come in.

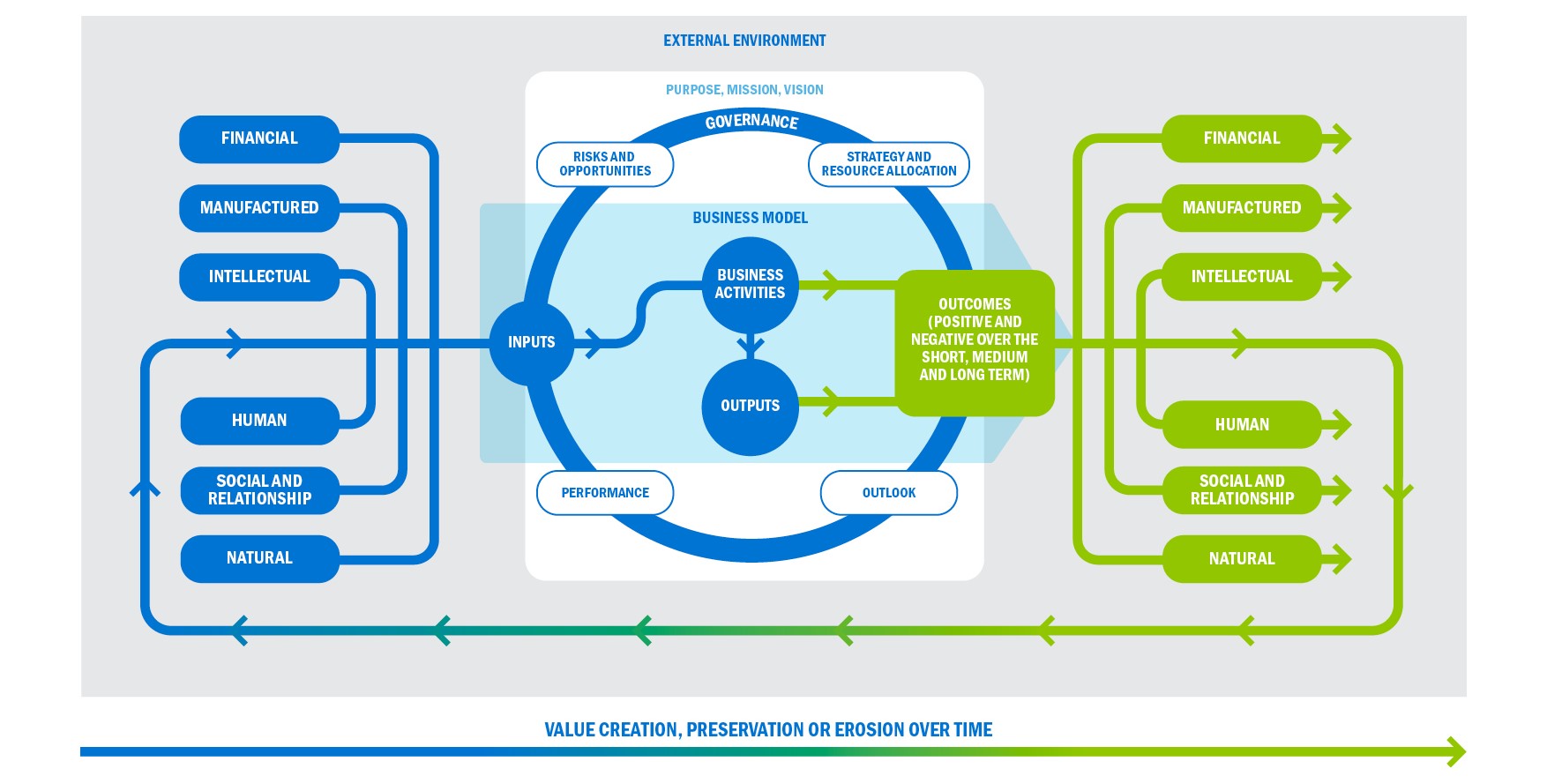

The capitals are stocks of value that are affected or transformed by the activities and outputs of an organisation. The <IR> Framework categorizes them as financial, manufactured, intellectual, human, social and relationship, and natural. Across these six categories, all the forms of capital an organisation uses or affects should be considered.

An organisation’s business model draws on various capital inputs and shows how its activities transform them into outputs.