The growing momentum for integrated reporting: Part 1

The goal of achieving global adoption of integrated reporting across all industry sectors is continuing to gain momentum, according to an in-depth study of adoption trends conducted by IFRS Foundation staff.

Integrated reporting enhances the way organisations think about, plan and report on business performance and provides insights into their future prospects through a multi-capital and value creation lens. More than 2,500 businesses in 70+ countries have adopted integrated reporting. The IASB and ISSB Chairs encourage the continued use of the Integrated Reporting Framework—now part of the IFRS Foundation—and commit to using its principles and concepts to help achieve a globally-accepted, comprehensive corporate reporting system.

A deep understanding of how integrated reporting is being adopted is necessary to increase levels of adoption and enhance the quality of integrated reporting globally.

Adoption of integrated reporting is occurring globally

In early 2022, IFRS Foundation staff conducted a research project to determine where and how the Integrated Reporting Framework is being implemented worldwide. Below are the findings related to geographical and sectoral distribution. Part 2 of this blog highlights key findings related to the alignment of the sampled reports with the Integrated Reporting Framework.

IFRS Foundation staff collect data on the global adoption of integrated reporting on an ongoing basis. From those efforts, we know that the Integrated Reporting Framework has been implemented by all types of organisations, including public companies, SMEs, and nonprofits. Out of the 2,500+ organisations known to produce an integrated report at the start of this research project, an initial sample of 1,700 was collected. From the initial sample, listed companies were retained for a deeper analysis due to the public availability of their reports.

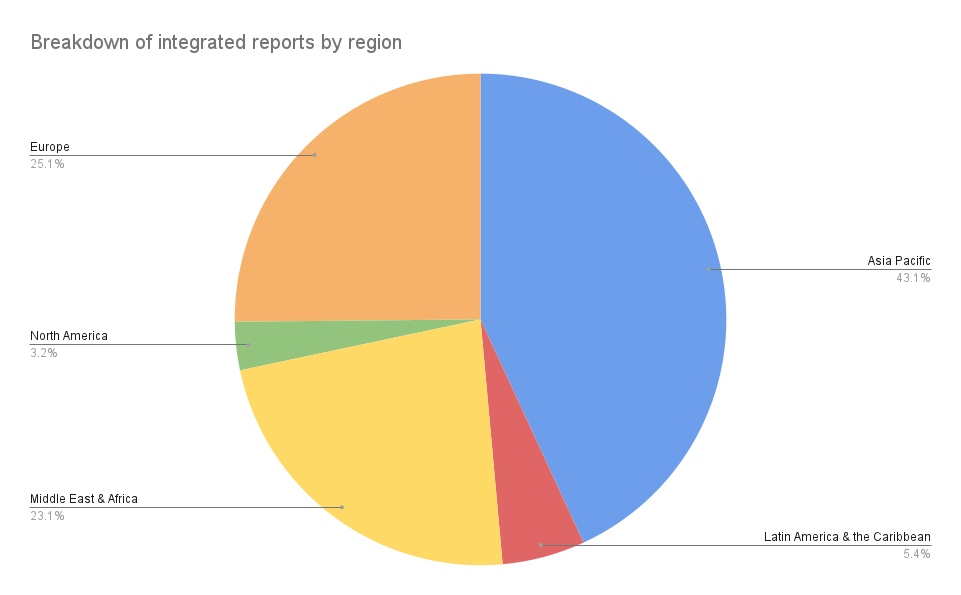

Based on the regional classification system used and the available data, it was observed that most integrated reports come from the Asia Pacific, Middle East and Africa, and Europe (continental Europe):

Within the regions there are some countries that are leaders in adopting integrated reporting. For instance, Japanese companies make up a large portion of the sampled reports in the Asia Pacific region. Integrated reporting has been widely adopted in Japan since 2015 when the Japanese Corporate Governance Code was introduced and the Integrated Reporting Framework was seen as an appropriate framework to implement the requirements of the Code. Companies that are listed on the Johannesburg Stock Exchange are required to publish an integrated report and make up most of the sampled reports in the Middle East and Africa region. Integrated reporting is practiced widely throughout Europe.

Integrated reporting is being adopted across all sectors

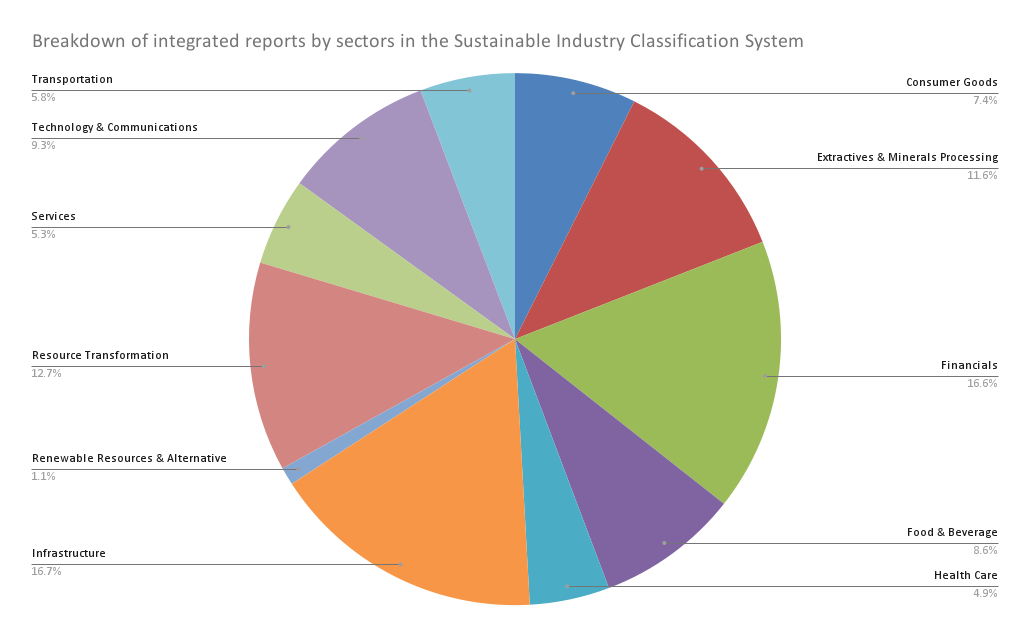

Sector analysis[1] indicated that companies across all sectors are producing integrated reports (see the figure below). The majority of the reports in the study came from entities in the Infrastructure, Financials and Resource Transformation sectors. Further investigation showed that integrated reports are being produced in 71 out of the 77 industries based on the Sustainable Industry Classification System® (SICS®), demonstrating the widespread adoption of integrated reporting.

A foundation for long-term value creation

Together, integrated thinking and integrated reporting provide a foundation for long-term value creation. Companies looking to begin their integrated reporting journey are encouraged to download the Integrated Reporting Framework, which provides guidance on the practicalities of producing an integrated report. Additionally, the Transition to integrated reporting: A guide to getting started resource helps preparers develop a custom-fit transition plan to integrated reporting.

The long-established business case for integrated reporting demonstrates how a multi-dimensional approach to value creation (based on six forms of capital) – and extending disclosure horizons beyond the short-term – can bring substantial benefits such as a lower cost of capital. This study aims to complement these findings and provide improved and up-to-date evidence on integrated reporting adoption.

We will continue to keep you updated as IFRS Sustainability Disclosure Standards are developed, providing further insights on how the Integrated Reporting Framework can support connectivity to IFRS Accounting Standards, and support an interconnected, holistic disclosure landscape.

[1] SICS are not available for ‘unlisted + delisted + n/a + ceased trading + other companies.