A cohesive and connected future for reporting in Europe

In 2014, the European Commission identified integrated reporting as ‘one step ahead’ of the Non-Financial Reporting Directive.

Hundreds of businesses across Europe should be commended for taking this step in the intervening years, with many of Europe’s largest businesses successfully embedding integrated thinking and reporting into the way they do business.

Driven by the desire to understand the role and impact of all of the resources and relationships (what the International <IR> Framework refers to as ‘capitals’) the organisation uses and effects, it has helped them to create effective and sustainable strategies for long-term value creation.

This has resulted in an enhanced quality in communications with investors and other key stakeholders, including customers, the supply chain and employees, building trust with these key audiences. It has driven more concise, targeted reporting on strategy, risks and opportunities and the different dimensions of value.

From SAP in Germany, which has used integrated reporting to understand the impact of employee engagement on their operating profit, to ABN AMRO in the Netherlands, which has used integrated thinking to pinpoint the key value drivers that will enable them to fulfil their purpose into the future, major European businesses are driving responsible capitalism through embedding the principles of International <IR> Framework.

In fact, uptake continues to grow in all of the major EU economies.

In France, 58% of the CAC40 now produce integrated reports, according to PwC. Uptake is also strong in Spain, the Netherlands and Italy where integrated reporting has been adopted as a corporate governance tool in both large and SME organisations.

In Germany, leading businesses including EnBW, BASF and Flughafen München (Munich Airport) are providing leadership in the field.

During the European Commission’s 2018 Fitness Check into corporate reporting, over 50% of respondents encouraged the Commission to pursue integrated reporting, and in its recent consultation on the Non-Financial Reporting Directive, the Commission has once again consulted on the role the International <IR> Framework should play as they consider whether to create a new reporting standard.

Over the last ten years, the IIRC has found with every market, business and investor it works with, real strides towards sustainable finance are only taken when there is more explicit connectivity between ‘financial’ and ‘non-financial’ to drive value creation.

When businesses embed the principles of integrated reporting they are better placed to be forces for good within society, more resilient at facing economic shocks thanks to more secure relationships with long-term investors and other stakeholders throughout the supply chain, and increasingly aware of their impact on the environment (as well as the impact the environment might have on it).

Integrated reporting goes hand-in-hand with the Taskforce for Climate-related Financial Disclosure recommendations (TCFD). These recommendations highlighted the intrinsic financial implications of climate – the integrated report is a mainstream reporting process that provides the link between the critically important issue of climate and financial performance, and also human, social, intellectual, manufactured and broader natural capital risks and opportunities.

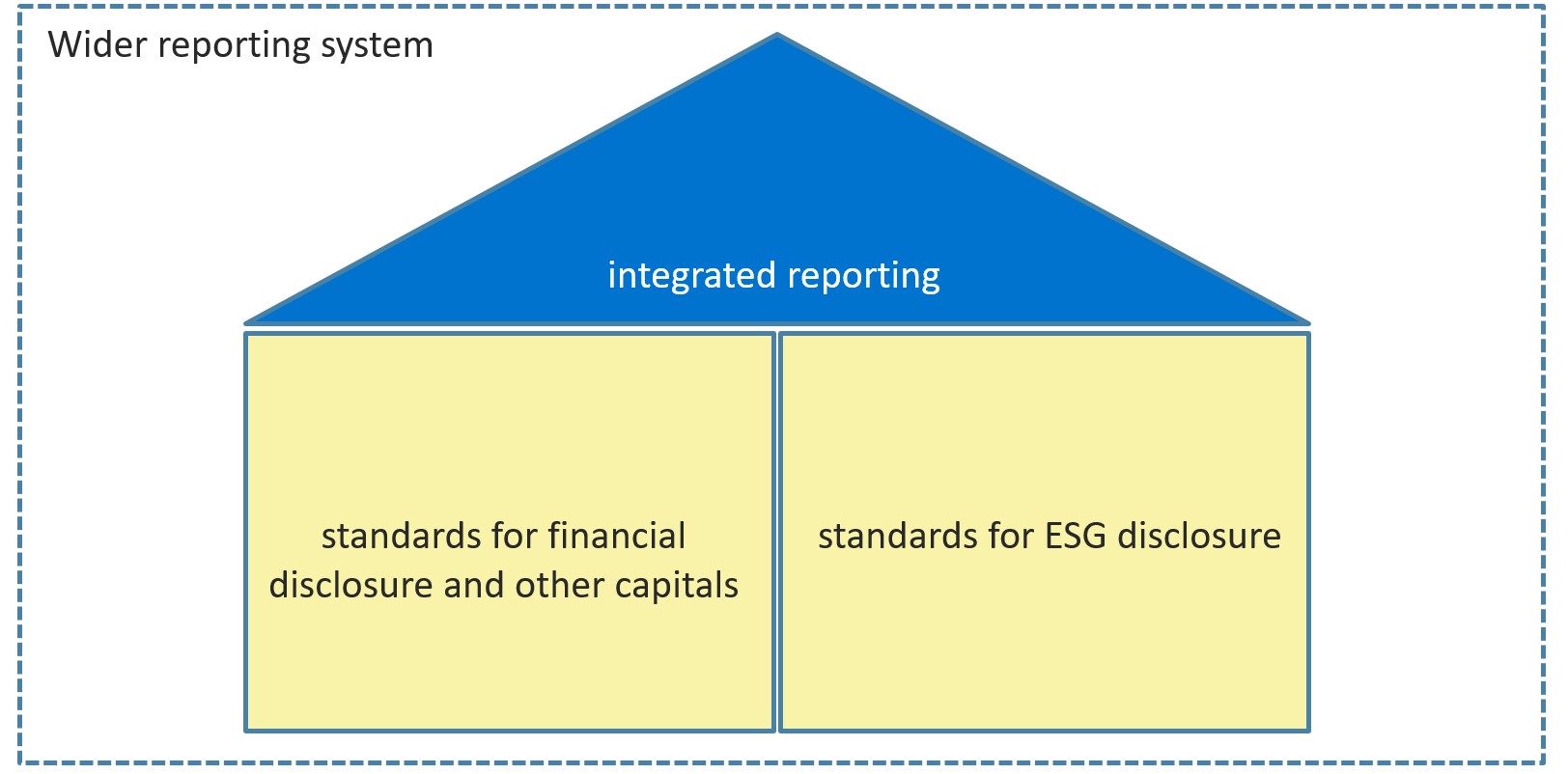

That is why the principles at the heart of the International <IR> Framework have been identified as the basis for a conceptual framework to bridge the current reporting standards.

In its response to the European Commission, the IIRC encouraged the Commission to work with the IIRC, the IASB as the major standard setter for financial disclosures in Europe, and GRI and SASB as the major standard setters for ESG disclosure, to create this cohesive, interconnected reporting system.

Whilst there are gaps that need addressing in the reporting standards already widely used, including around intellectual, relationship and manufactured capitals, businesses already have access to standards and frameworks to guide them towards effectively reporting their value creation story, that can become the foundation of the European Commission’s new all-encompassing standard.

During this process the IIRC has three clear recommendations:

- Drive connectivity of information to ensure sustainable development issues are mainstream factors within decision-making and resource allocation

- Reduce the reporting burden by working with existing framework providers and standard setters businesses across Europe already use to report effectively.

- Demonstrate clear linkages between all information that impacts on value creation over time, reducing the need to distinguish between financial and non-financial information which can be misleading.

The Non-financial Reporting Directive represented a major advancement in the reporting of key issues such as human rights, climate change, and supply chains.

The next step the European Union takes has the potential to be even more powerful – providing crucial clarity into a holistic, sustainable, interconnected reporting system can work – a system that, ultimately, can be implemented globally.